Episode 2: What Kind of Company Do You Want To Be? Ft. Clay Sifford

Clay Sifford, CEO and Founder, shares the story behind how LASSO came to be on this week's episode hosted by Angela Alea. Listen in as they unpack...

Angela breaks down the difference between 1099 vs. w2 and most importantly, why people miss out on far too much money and opportunities due to misunderstanding this.

Angela Alea: Welcome back to another episode of Corralling the Chaos. Today I want to dive into a big misconception that so many great event professionals have about how they're classified as either a 1099 or a W2. The reality is most people want to be a 1099 for two obvious reasons.

[00:00:21] Angela Alea: The first one is you get flexibility over your schedule. You get to decide when to work and when not to, and you get the ability to write off expenses. Both of those are fantastic and valid reasons.

However, I think our industry has operated this way for far too long with far too many misconceptions. And most importantly, people are missing out on far too much money and opportunities because of their misunderstanding of this.

[00:00:49] Angela Alea: So before we quantify the financial differences of being a 1099 versus a W2, I want to spend a quick minute understanding why is this even a thing?

So there are two big distinctions in the eyes of the IRS and the Department of Labor when it comes to being a 1099 or a W2. And I want to start with the IRS.

[00:01:13] Angela Alea: The IRS has a stake in you being a W2 because they want their money, the tax revenue (thank you, lovely IRS), but it's harder to track if you're a 1099. So that's one reason why we've all seen the attention on misclassification over the last five to seven years and things like AB5 in California, which more strictly defines those parameters for being able to be classified as a 1099.

[00:01:40] Angela Alea: I hate to tell you, but these things are here to stay and they're going be expanding into the other states–California just started it. It's also a misconception that California is the only state that's placing a priority on this. All of them are! Misclassification is a thing in all 50 states because the reality is the IRS crosses all 50 states.

[00:02:03] Angela Alea: And again, they want their tax revenue, but that's also where the Department of Labor or the DOL plays a role. Here's the actual mission of the Department of Labor: the mission of the Department of Labor is to foster, promote, and develop the welfare of the wage earners, job seekers, and retirees of the United States, improving working conditions, advance opportunities for profitable employment and assuring work-related benefits and rights.

[00:02:35] Angela Alea: So again, it's all about you, the employee. These things were created to protect you, to make sure you are getting paid the right amount, and are given access to the benefits and accommodations you need. All of these things are to protect you the employee. So out of this initiative through the Department of Labor has come hundreds of these two and three-letter acronyms of rules that businesses have to follow in an effort to protect you, the W2 employee, not you the 1099. As a 1099, you don't get these protections.

Here are a few of the laws in place that are designed to protect W2 employees. The first one is the FLSA. That stands for the Fair Labor Standards Act. These are things that you get protection on to make sure you're getting paid a reasonable wage, you're getting overtime.

Hey, heads up, if you're working five 10-hour days, you don't get any overtime as a 1099. As a W2, you get 10 hours of overtime! So those are some of the things they look for. In addition, child labor laws and my favorite frequency of payroll. I bet a lot of you didn't know that it's actually illegal in most states to pay you more than 12 days after you worked.

[00:03:51] Angela Alea: I'm going to take that a step further. [For] those of you that have to wait a month to get paid, that would never happen as a W2! Companies who W2, I'm sure, would love to 1099. It's cheaper and better for them. The next one is the ACA, the Affordable Care Act.

[00:04:09] Angela Alea: There's also the Americans with Disabilities Act there's OSHA, there's FMLA, there's EEOC. So that's what I mean by all of these two and three-letter acronyms that are designed to protect you the employee, not you the 1099. So again, another big distinction here. I just want to make sure.

[00:04:29] Angela Alea: If you're a W2, guess what? You still get flexibility over your schedule. You still get to write off things on your taxes, but now you get all of these other benefits. W2-ing a workforce is much more expensive and time-consuming for companies that choose to do that. There is literally zero in it for the company and everything in it for you when they W2 you.

[00:04:50] Angela Alea: The companies pay more in taxes and an exorbitant amount in overhead to process payroll, do tax filings, and workers' comp audits all while trying to be compliant with all of these "rules".

[00:05:12] Angela Alea: So let's shift the conversation. What's in it for you to be a W2? So again, keeping in mind all the advantages that you get by being a 1099, you still get to freelance. You still get to work for whoever you want. You still get to work for multiple companies. You still get the write-off on your taxes, your expenses, all the good things you love about being a 1099 still exist in this framework.

[00:05:30] Angela Alea: But if you become a W2, here are several things that you also get the benefit of. When you become a W2, you now pay half the amount in taxes. This is the biggest misunderstanding! As a W2, you only pay the employee portion of taxes and now the company pays the employer portion. So you're literally going to give yourself a 10% raise by becoming a W2, which we're going to break down in just a minute. We're going to quantify this for you. I think you're going to be shocked with the amount of money that 1099s leave on the table when they choose to 1099.

[00:05:51] Angela Alea: Number two, you still get the flexibility to work when you want. I'm going to say it again. You still get to be a freelancer, own your own schedule, say yes to the gigs you want, no to the gigs you don't want, and work for multiple companies.

[00:06:14] Angela Alea: You also save money on workers' compensation because the companies by law have to provide that coverage for you if you're a W2. And no longer do you have to worry about showing certificates of insurance, making sure your worker's comp is up to date. You also get paid faster and without having to generate invoices.

[00:06:34] Angela Alea: So remember companies who W2, every state has different laws about how often they can run payroll. It's illegal to do a Net 30, as I said. In most states, you have to get paid within at least 12 days of when the work was completed. So no more chasing your money.

[00:06:56] Angela Alea: The biggest misconception though, is you can still write off your expenses, although often it's more advantageous to take advantage of the standard [deduction rather than the itemized. So it's up to you, depending on how many expenses you're kind of racking up, as to whether you do the standard or the itemized [deduction].

[00:07:14] Angela Alea: Number six, you get access to benefits like unemployment. I don't know how many of you during COVID couldn't get unemployment. At LASSO, we paid hundreds and hundreds of unemployment claims because we W2 everybody. Also at LASSO, if you're a W2 (not all companies do this, but), you're also able to participate in our 401k with a company match. HINT–that's free money! When we're matching what you contribute towards your retirement, that's free money!

[00:07:34] Angela Alea: Also like I said earlier, if you were to work five 10-hour days as a 1099 there's no OT, right? There's no overtime. As an employee though, you get 10 hours of overtime because it's the law! Obviously, if it's in California, you're going to get it after eight hours in that day.

[00:07:59] Angela Alea: I could keep going on many of the intangibles, but for today, I really just want to highlight the tangible advantages. So let's break down the numbers and quantify why you're leaving money on the table if you're a 1099.

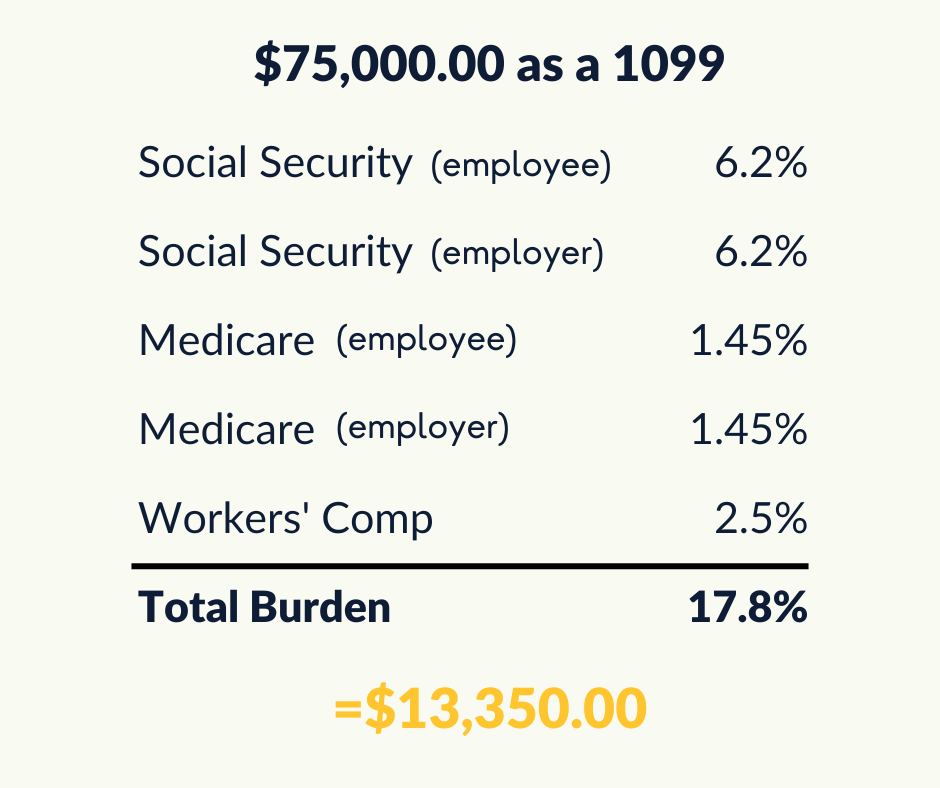

So for this example, let's assume you make $75,000 a year in our industry. If you make more congrats, you're going to save more, which you'll see when you run these numbers. But as a 1099 making $75,000 per year, this is what you are obligated to pay.

[00:08:22] Angela Alea: Okay so I'm going to break down taxes and workers' comp. As an independent contractor, many of you have probably heard the term FICA. That is made up of your Social Security tax and Medicare.

If you're a 1099, you are the employee and the employer because you're self-employed. (The IRS is not going to say, "Oh great if you're a 1099, we'll just take half the taxes." They're going to get their money regardless!)It's just instead of a company paying half of it because you're the employer and employee, you pay all of it.

[00:09:00] Angela Alea: So let's break that down: $75,000 a year. You're going to pay Social Security as an employee of 6.2%. You're going to pay the same amount as your own employer of 6.2%. Then, you're going to pay Medicare. The Medicare tax as an employee is 1.45% and you're going to pay Medicare as the employer of 1.45%. So that makes your taxes as a 1099 15.3%.

[00:09:25] Angela Alea: But all of you know, you're still required to show you carry workers' comp on yourself. So let's be conservative and assume your workers' comp is costing you 2.5%. Many of you know, we're in an industry where it's expensive to get workers' comp so we're going to be conservative though.

[00:09:49] Angela Alea: So your taxes are 15.3% and your workers' comp's 2.5%. That means on $75,000 a year, you're going to pay 17.8% of your income which equals $13,350. Okay, so that's your tax and workers' comp burden as a 1099.

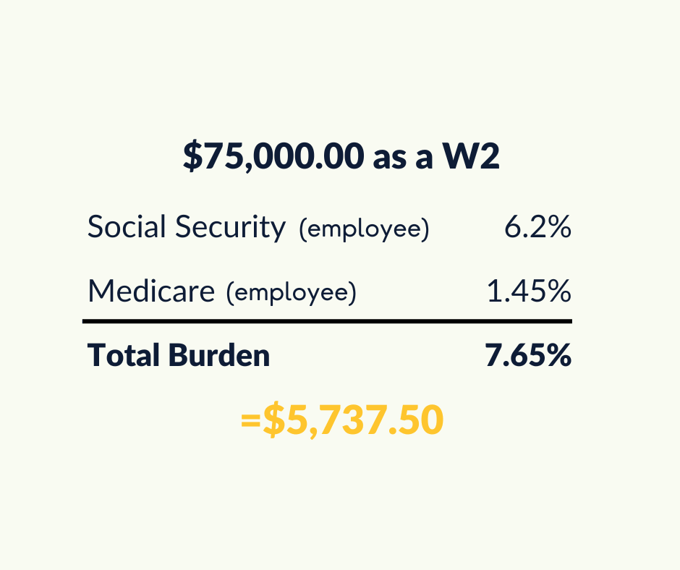

[00:10:00] Now let's run the numbers if you were a W2 making $75,000. Here, you're only the employee because whoever hires you, now it's going to cost them as the employer so they've got to pay that portion for you. So now as a W2, you're going to pay social security as an employee only of 6.2%.

[00:10:17] Angela Alea: You're also going to pay Medicare tax as an employee of 1.45%. Now, because you're a W2, your employer is now required to pay the same in taxes and provide your worker's comp. So that leaves your total cost as a W2 at only 7.65%, which is a little over $5,700.

So for those of you making roughly $75,000, that means you save over $7,600 in real dollars. That doesn't include not having to generate invoices, waiting Net 30 to get paid, all while still owning your own schedule and writing off expenses.

[00:10:58] Angela Alea: These are the facts. The math is the math. Our industry is changing and it's actually becoming even better for the people working in it. You know, a decade ago, it was unheard of for a company to W2. Now more than the majority of our industry is doing that. And yet, so many professionals are hesitant to get a W2 because they don't understand what it really means for them.

[00:11:23] Angela Alea: These companies that are W2ing, there is literally nothing in it for them. It's more expensive to do it, but it allows them to be compliant and it's good for you. So I don't want that to be lost on you.

[00:11:48] Angela Alea: So to wrap this up, I encourage all of you to dig into the facts. Stop listening to the people with the wrong information, or who are saying things like, "this is just how our industry has always worked." In case you haven't been paying attention, the world is changing, not just our industry!

Those who pay attention, adapt, stay in the know about the facts–you all have a real opportunity ahead, so stop leaving money on the table. What worked before is no longer working and is no longer applicable every single date, state or federal mandates come down for businesses, and guess what yhey're about? All about how they have to take care of you, their W2'd employee. That's the way the world is moving: employee-friendly, employee-focused. So keep that in mind.

[00:12:25] Angela Alea: We always love to get your feedback and this is no doubt, a hot topic. So feel free to reach out to me with your comments, your thoughts, and your opinions directly at angela.alea@lasso.io or reach out to us at podcast@lasso.io.

[00:12:41] Angela Alea: And certainly don't forget to subscribe! Thanks so much, everyone.

Clay Sifford, CEO and Founder, shares the story behind how LASSO came to be on this week's episode hosted by Angela Alea. Listen in as they unpack...

Meet our host, Angela Alea, the President and Chief Revenue Officer at LASSO, as she leads our audience on a mission to set order to chaos in the...

Join us in redefining our payment expectations for evolving industries. Let's resolve the common misconceptions about low bill rates and challenge...

Find industry insights, tools, and tactics for event and entertainment production companies, event staff and security, and crew members. Subscribe today to stay in the loop!